Capitalism needs

bubbles to keep itself afloat

Draft

Draft

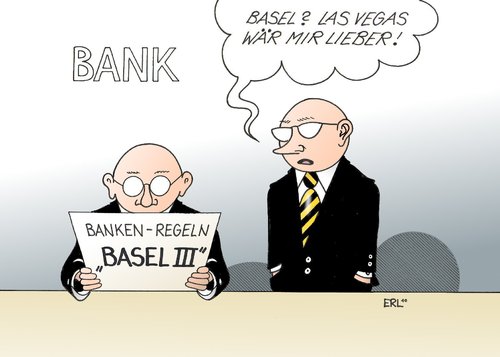

Today international

financial regulators came together in Basel to re-adapt, soften the Basel III

rules. The Basel III rules had been agreed by the G20 in the aftermath of the

crisis to avoid a new “Great recession” in the future. These Basel rules would

be implemented from 2013 until 2018. Their main objective was to limit the

amount of risks of bank investments. As a bank asks deposits of people and

invests this loaned money in the economy – through credit-lines, investments or

loans – it takes the risk that these loans are not paid back and gets a (high)

profit in return. In order to ensure that the deposited money is paid back to

the people having deposits (bank-accounts), it needs a buffer to compensate

possible losses. This buffer is the so-called capital base or the “own capital”

of the share-holders. The Basel-agreements state which capital can be seen as “own

capital” and how high this buffer should be. This buffer limits the amount of risks and

investments a bank can make.

A very

simplified example could be like this: If capital requirements would be of 10%

of Tier I capital (in its current definition), this would for example mean that

a bank need 1 billion dollars invested by its shareholders, to ask 9 billion of

saving-accounts, in order to invest 10 billion dollars. If those 10 billion

would create a profit of 10%, the bank would get 1000 million, of which it had

to give 180 million to the deposit-holders (at 2% interest). This would mean

that the bank would make 820 million dollar profits for an invested capital of

1 billion, or 82% a year. – If however the economy is going bad, and a bubble

bursts, these 10 billion make losses 5% for example, only 9,5 billion remains.

Deposit-holders (9 billion) and their 2 percent interests (180 million) have nevertheless

to be paid back, so only 320 million remain of their initial 1 billion profits.

If the losses would be 10% or more, they would have losses of 1,180 million on

their 1,000 million invested and the bank would go bust…

How higher

the capital buffer, the less risk the bank has to go bust. Bank default risks

the creation of global financial catastrophes, particularly, if all banks have

big losses as a consequence of “systemic risk”, a global economic downturn or

capitalist recession, destroying the “financial stability” of the system and

requiring state-intervention at the cost of the taxpayers, as we have seen in

2008. In the months following the biggest

financial crash ever, the global political and industrial elite, showed the

intension of being hard on the financial elite, as their “casino-capitalism”

was ruining their real political economy with their risk-taking. The G20, lead

by Sarkozy, made agreement on tougher regulation, as the soft regulation was

seen as the cause of the crisis. These negotiations between states and

financial regulator lead to the agreement of the new Basel III agreements,

which had always been harshly opposed by the global financial elite. These argued

that stronger regulation would endanger the recovery from the crisis, as it

would cut the available money-supply for investing in the economy and provide

purchasing power.

As a matter

of fact, both were right. No extra regulation would mean a big risk to the

stability of the system. Extra regulation would have a negative impact on

growth, and provoke a possible depression. This contradiction is an expression

of the contradictions within capitalism itself. The contradiction was

trespassed temporarily in 2011, through the development of harsher rules of

Basel III, on capital requirements for example – though still very liberal in

comparison with the regulation during the Keynesian Bretton-Woods age, and

before the introduction and development of neoliberal financial liberalization and

globalization, as well as the development of the battery of complex structured

financial investments as we know them now – but with an agreement to implement

them only over time; concretely, the first measures would be only implemented from

2013 and finished in 2018.

Now, in 2013,

when the first regulations would begin to be implemented, they are already

softened. What could already be predicted in 2011, that the new regulations

would be only window-dressing proves to be right. You cannot make regulations

more strictly, when the world economy risks being re-thrown in a recession. At

the same time, the financial world is already back again on its ancient track. Financial

risks have never been greater, as recent OESO pointed out in its analysis of

the European bank sector this week… but weak regulations, monetary financing by

the ECB, the rescue packages of the FED, the billions of the European troika to

save the European banks, etc… have also brought profits back to pre-recession

hights. The music is playing again, the bubles and balloons are back for the

party… and "as long as the music is playing, you've got to get up and

dance," as Prince, the former CEO of citibank said in 2007, months

before the crash of Bear Stearns and IAG.

As in 2007,

everyone involved can see that if there would be a recovery – ‘recovery’ is a

bad worth for a weak contention of a deep recession due to the Euro-crisis and

a new banking crash – this recovery is fictitious, as unemployment is still

rising, purchasing power is decreasing and government finances of most

countries are not really healthy. Since the 1970’s capitalism has delt with its

structural over-production crisis trough debt-financing of consumption, through

financial liberalization. In order to keep consumption and accumulation growing

it created an immense financial sphere, with financial titles that are totally

disattached from the real economy and are no more than virtual value-forms. It

needed these instruments to keep up its growth and restore its profits during

the last 30 years: Capitalism needs the bubbles to keep itself afloat.

This is de

reason why the Basel III agreements have been softened, and why a new financial

crisis probably will not take long to emerge.

No comments:

Post a Comment